Sole Trader Declare Income . Paying yourself as a sole trader or limited company? sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. A sole trader is a person who works for themselves as an incorporated business. How much to set aside for uk taxes when self. What is a sole trader? It’s best to register as soon.

from www.allbusinesstemplates.com

It’s best to register as soon. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. How much to set aside for uk taxes when self. A sole trader is a person who works for themselves as an incorporated business. Paying yourself as a sole trader or limited company? What is a sole trader?

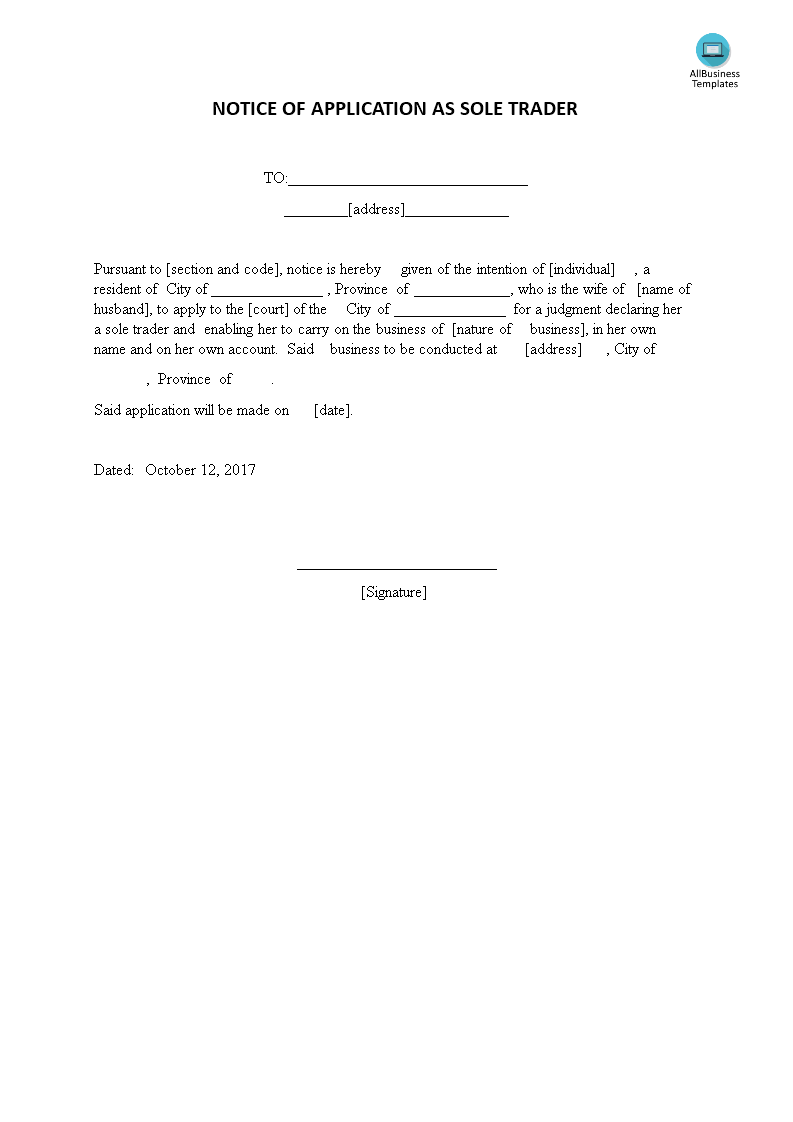

高级 Notice Of Application As Sole Trader 样本文件在

Sole Trader Declare Income sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. It’s best to register as soon. What is a sole trader? A sole trader is a person who works for themselves as an incorporated business. How much to set aside for uk taxes when self. Paying yourself as a sole trader or limited company?

From www.scribd.com

Balance Sheet format for a sole trader Sole Trader Declare Income How much to set aside for uk taxes when self. Paying yourself as a sole trader or limited company? sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. A sole trader is a person who works for themselves as an incorporated business. It’s best. Sole Trader Declare Income.

From teachsa.co.za

i. Financial accounting of a sole trader TeachSA Sole Trader Declare Income sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. How much to set aside for uk taxes when self. Paying yourself as a sole trader or limited company? A sole trader is a person who works for themselves as an incorporated business. What is. Sole Trader Declare Income.

From nailbay1dalton.wordpress.com

Grow Your Sole Trader Tax Consulting Service The Proper Way The Life Sole Trader Declare Income It’s best to register as soon. Paying yourself as a sole trader or limited company? How much to set aside for uk taxes when self. A sole trader is a person who works for themselves as an incorporated business. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax. Sole Trader Declare Income.

From swoopfunding.com

What sole traders need to know about funding their business Swoop UK Sole Trader Declare Income What is a sole trader? A sole trader is a person who works for themselves as an incorporated business. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. How much to set aside for uk taxes when self. Paying yourself as a sole trader. Sole Trader Declare Income.

From www.greenaccountancy.com

Sole Trader & Personal Tax Green Accountancy Sole Trader Declare Income It’s best to register as soon. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. What is a sole trader? How much to set aside for uk taxes when self. A sole trader is a person who works for themselves as an incorporated business.. Sole Trader Declare Income.

From db-excel.com

Sole Trader Spreadsheet Template — Sole Trader Declare Income How much to set aside for uk taxes when self. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. A sole trader is a person who works for themselves as an incorporated business. What is a sole trader? Paying yourself as a sole trader. Sole Trader Declare Income.

From www.real-price.co.uk

Product detail Sole Trader Declare Income It’s best to register as soon. What is a sole trader? Paying yourself as a sole trader or limited company? A sole trader is a person who works for themselves as an incorporated business. How much to set aside for uk taxes when self. sole traders don’t have to register with companies house, but they do have to maintain. Sole Trader Declare Income.

From studylib.net

Sole trader financial statements 3 Sole Trader Declare Income Paying yourself as a sole trader or limited company? A sole trader is a person who works for themselves as an incorporated business. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. It’s best to register as soon. How much to set aside for. Sole Trader Declare Income.

From www.legendfinancial.co.uk

What Being a Sole Trader Means Their Roles & Liabilities Sole Trader Declare Income It’s best to register as soon. Paying yourself as a sole trader or limited company? A sole trader is a person who works for themselves as an incorporated business. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. How much to set aside for. Sole Trader Declare Income.

From www.studocu.com

Unit 5 Preparation of Financial Statement for a Sole trader Sole Trader Declare Income What is a sole trader? A sole trader is a person who works for themselves as an incorporated business. How much to set aside for uk taxes when self. Paying yourself as a sole trader or limited company? sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and. Sole Trader Declare Income.

From www.parpera.com

How to Complete Your Tax Return as a Sole Trader Parpera Sole Trader Declare Income It’s best to register as soon. How much to set aside for uk taxes when self. A sole trader is a person who works for themselves as an incorporated business. What is a sole trader? sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self.. Sole Trader Declare Income.

From www.greenaccountancy.com

Sole Trader & Personal Tax Green Accountancy Sole Trader Declare Income A sole trader is a person who works for themselves as an incorporated business. Paying yourself as a sole trader or limited company? sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. What is a sole trader? It’s best to register as soon. How. Sole Trader Declare Income.

From www.accounting-tuition.com

Chapter 1 Final accounts of soletrader Accounting Tuition Sole Trader Declare Income A sole trader is a person who works for themselves as an incorporated business. How much to set aside for uk taxes when self. What is a sole trader? It’s best to register as soon. Paying yourself as a sole trader or limited company? sole traders don’t have to register with companies house, but they do have to maintain. Sole Trader Declare Income.

From www.scribd.com

Fact Sheet Financial Statements For Sole Traders PDF Sole Trader Declare Income It’s best to register as soon. Paying yourself as a sole trader or limited company? A sole trader is a person who works for themselves as an incorporated business. How much to set aside for uk taxes when self. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax. Sole Trader Declare Income.

From www.legendfinancial.co.uk

What Being a Sole Trader Means Their Roles & Liabilities Sole Trader Declare Income How much to set aside for uk taxes when self. What is a sole trader? sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. It’s best to register as soon. Paying yourself as a sole trader or limited company? A sole trader is a. Sole Trader Declare Income.

From www.greenaccountancy.com

Sole Trader & Personal Tax Green Accountancy Sole Trader Declare Income It’s best to register as soon. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. How much to set aside for uk taxes when self. What is a sole trader? Paying yourself as a sole trader or limited company? A sole trader is a. Sole Trader Declare Income.

From rounded.com.au

Sole Trader Tax Guide Rounded Sole Trader Declare Income sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. A sole trader is a person who works for themselves as an incorporated business. What is a sole trader? How much to set aside for uk taxes when self. Paying yourself as a sole trader. Sole Trader Declare Income.

From www.youtube.com

FINANCIAL STATEMENTS OF A SOLE TRADER STAMENT ACCOUNTING FOR Sole Trader Declare Income A sole trader is a person who works for themselves as an incorporated business. sole traders don’t have to register with companies house, but they do have to maintain accounting records, pay income tax and file a self. It’s best to register as soon. Paying yourself as a sole trader or limited company? How much to set aside for. Sole Trader Declare Income.